The creation of your first trading method is very exciting. People start with small investments to know the nature of this market. Eventually, they focus on the complicated price variable and come up with a unique strategy. But do you know that most people in the United Kingdom create the first trading method in the wrong way? There are a few things which you need to consider for the creation of the first trading method. It is nothing very complex but still, rookies avoid these.

For many traders, buying a featured trading method from the online website might be a perfect solution but it is not. The trading method must synchronize with your personality. Unless you take your trade by focusing on a personally developed trading method, you are not going to survive in the investment business. Let’s read about the key steps that you must know how to create a trading strategy.

Know the tools in the demo account

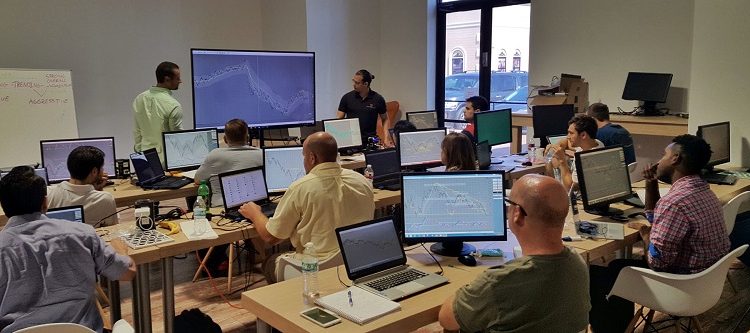

The demo account is known as your training ground. You have to test different kinds of trading methods in the demo environment. By choosing the demo trading account, you will be able to fine-tune the trading method without getting exposed to real-life risk. So, what about emotional development? You don’t have to focus on emotional development during the strategy development phase. The only thing that you need to focus on is the tools that you will be using on the demo account. By taking advantage of the advanced tools, crafting the trading strategy will become easier.

Get access to a professional broker

To develop a well-balanced trading strategy, you need to sign up for a free trial with Saxo. The reason for which we are asking you to demo trade with Saxo is their proprietary platform. With the help of their proprietary platform, traders can take quality trades without having any issue. You can also learn trading by using the traditional and normal platform. But it’s always great to learn the use of sophisticated tools especially when you get it for free. Take advantage of the free resources so that you don’t have to mess things up while trying to trade in the real market.

Knowing about the stages of the trend

To create your very first trading method, you need to know the phases of the trend. Knowing about the different stages of the market trend allows you to take trades with discipline. It improves your profit taking the opportunity and help you to earn more money. Though it might seem a little bit complex at the initial stage once you learn to take trades with discipline, you will slowly learn to trade with proper risk factors. Never try to boost the profit by picking tops and bottoms. Such an approach never works. Nicely craft the trading edge so that you can always take the trade with the trend. Never try to be a big fan of retracement as it will cost you.

Back-testing the system

The last thing you need to do is to back-test the system. Since every trading strategy is based on support and resistance, you must know you are taking trades at the support and resistance. To do so, back-test the system with the demo platform. You should execute a minimum of thirty trades and only then will you be able to make the best profit from this market. Never try to trade with real money without back-testing the system. It’s more like taking the trades with managed risk and still not having confidence in the system. After you have done the back-testing, revise the system if necessary. If not, start making a decent living out of trading by using the first simple strategy you have ever created.